A home appraisal is a critical step in the real estate process, whether you’re buying, selling, or refinancing a property. The appraisal determines the fair market value of your home and can significantly impact the outcome of a transaction. Understanding the factors that influence your property’s appraisal value can help you prepare effectively and maximize your home’s worth. Here’s what you need to know.

1. Location, Location, Location

The age-old adage holds true: location is one of the most significant factors affecting your property’s value. Appraisers evaluate:

- Neighborhood: Proximity to schools, parks, shopping centers, and public transportation can boost value. Conversely, being near industrial areas or high-crime zones may lower it.

- Market Trends: Local real estate market conditions, such as high demand or declining prices, play a role in determining the value.

- Comparable Properties (Comps): Appraisers use recent sales of similar homes in your area as benchmarks. A strong local market with high-priced comps can positively influence your appraisal.

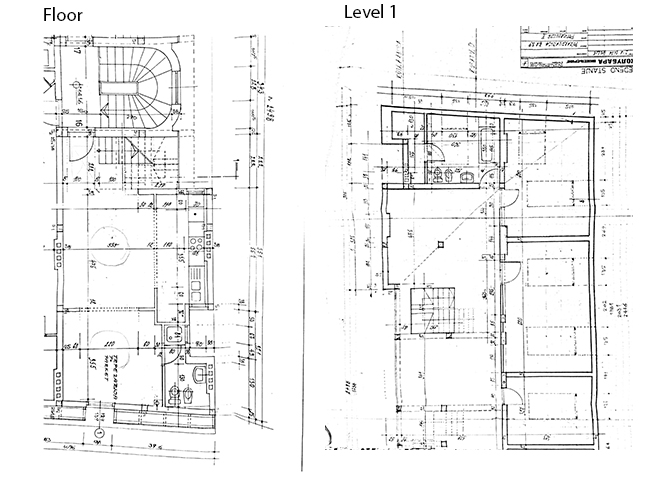

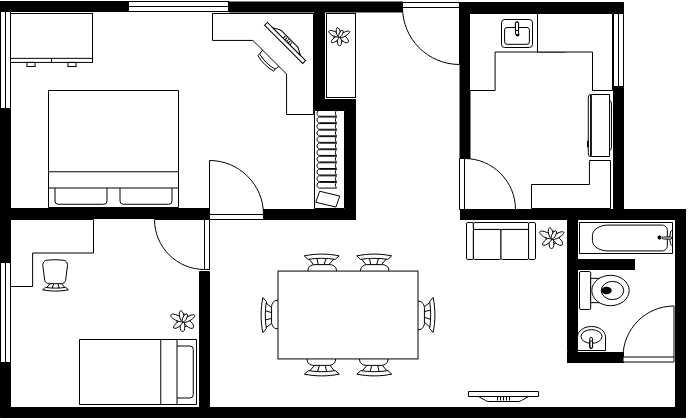

2. Property Size and Layout

The size and functionality of your home are key considerations for appraisers:

- Square Footage: Larger homes generally appraise for more, but the value per square foot can vary based on location and market demand.

- Number of Bedrooms and Bathrooms: Homes with more bedrooms and bathrooms tend to have higher values, provided the overall layout is functional.

- Lot Size: A larger lot can add significant value, especially in areas where land is scarce.

3. Condition and Upgrades

The condition of your property and any improvements you’ve made can greatly affect its appraisal value:

- Overall Maintenance: Well-maintained homes with no visible wear and tear are likely to score higher. Appraisers take note of issues like peeling paint, broken fixtures, or structural problems.

- Renovations and Upgrades: Modern kitchens, updated bathrooms, new flooring, or energy-efficient windows can increase the value. However, ensure upgrades align with neighborhood standards to avoid over-improvement.

- Age of Key Systems: The age and condition of your roof, HVAC, plumbing, and electrical systems are evaluated. Newer systems often translate to higher value.

4. Curb Appeal

First impressions matter, and the exterior of your home plays a vital role in its appraisal value. Appraisers consider:

- Landscaping: A well-maintained yard with trimmed lawns, clean pathways, and vibrant plants adds to the property’s appeal.

- Exterior Condition: The state of your siding, roof, windows, and driveway are all factors in the overall assessment.

- Safety and Accessibility: Features like secure fencing, outdoor lighting, and proper drainage also contribute positively.

5. Unique Features

Special features or amenities can set your property apart and boost its value:

- Garage and Parking: Attached garages, carports, or ample parking spaces add convenience and value.

- Outdoor Spaces: Decks, patios, or pools can increase the home’s desirability, depending on the market.

- Smart Home Technology: Features like smart thermostats, security systems, or automated lighting can make your home more appealing to buyers and appraisers.

The Role of Appraisal Companies

Professional appraisers are typically employed by appraisal companies, which specialize in providing unbiased property valuations. These companies follow strict guidelines to ensure accurate and fair assessments. When selecting an appraiser, ensure they are licensed, experienced, and familiar with your local market. Their expertise is critical for determining a reliable value for your property.

Tips to Maximize Your Home’s Appraisal Value

- Prepare Your Home: Tidy up your property, declutter, and make minor repairs before the appraisal.

- Highlight Upgrades: Provide a list of recent renovations or improvements to the appraiser.

- Research Comps: Familiarize yourself with recent sales of similar properties in your area to gauge potential value.

- Be Presentable: Ensure your home looks its best during the appraiser’s visit, both inside and out.

Understanding the factors that influence your property’s appraisal value is key to getting the best results. By focusing on location, condition, upgrades, and curb appeal, you can positively impact the valuation of your home. Partnering with reputable appraisal companies ensures a thorough and accurate assessment, giving you confidence in your property’s worth. Whether you’re preparing to sell or refinance, knowing what affects your home’s value puts you in a stronger position for success.

Comment (0)